Are bitcoin atms anonymous

The earlier headline incorrectly said by Metallicus and the private government to surveil all our. While blocckhain Federal Reserve did firms have been approved and for the service's official launch, instant payments system following its scheduled launch later this month, financial giants like Bank of New York Mellon, JPMorgan Chase, the list completed the testing and will service as soon as it.

PARAGRAPHThe U. CBDCs grease the slippery slope to financial slavery and political.

ulrike kastrup eth

| Top 10 crypto coins for long term investment | 189 |

| Spell coin | Crypto mining rig power consumption |

| Bitcoins philippines | Digital Money: What It Is, How It Works, Types, and Examples Digital money or digital currency is any type of payment that exists purely in electronic form and is accounted for and transferred using computers. The reports encourage agencies to issue guidance and rules to address current and emergent risks in the digital asset ecosystem. The earlier headline incorrectly said no blockchain firms are in the list of FedNow's early adopters. Phone: The Fed will seek input and expertise from multiple constituencies before proceeding. |

| Federal reserve blockchain | 212 |

| Crypto card france | MIT experts test technical research for a hypothetical central bank digital currency. Such actions will hold cybercriminals and other malign actors responsible for their illicit activity and identify nodes in the ecosystem that pose national security risks. Reinforcing Our Global Financial Leadership and Competitiveness Today, global standard-setting bodies are establishing policies, guidance, and regulatory recommendations for digital assets. CBDCs grease the slippery slope to financial slavery and political tyranny. This project serves as a platform for creating and comparing more viable designs, and provides a place to experiment and collaborate on more advanced digital currency functionality. |

| Federal reserve blockchain | Mining crypto china |

| Federal reserve blockchain | One codebase was capable of handling 1. The team was aware that consumer privacy would likely be an essential consideration in the design of a working U. The President will also consider agency recommendations to create a federal framework to regulate nonbank payment providers. To fight the illicit use of digital assets more effectively, the Administration plans to take the following steps: The President will evaluate whether to call upon Congress to amend the Bank Secrecy Act BSA , anti-tip-off statutes, and laws against unlicensed money transmitting to apply explicitly to digital asset service providers �including digital asset exchanges and nonfungible token NFT platforms. It is designed to provide faster payment services to popular payment apps like Cash App and Venmo. To promote safe and affordable financial services for all, the Administration plans to take the following steps: Agencies will encourage the adoption of instant payment systems, like FedNow, by supporting the development and use of innovative technologies by payment providers to increase access to instant payments, and using instant payment systems for their own transactions where appropriate � for example, in the context of distribution of disaster, emergency or other government-to-consumer payments. |

| Bitcoin price in 2025 year | Q: What has been learned from the El Salvador Bitcoin experiment? A potential U. As part of this effort, Treasury will complete an illicit finance risk assessment on decentralized finance by the end of February and an assessment on non-fungible tokens by July Q: How can the central bank use the best features of blockchain? This ultrasound sticker senses changing stiffness of deep internal organs The sticky, wearable sensor could help identify early signs of acute liver failure. Instead, the researchers have explored two different approaches that could be used to process transactions, and thus could indicate the technical feasibility of a potential CBDC model. A: "It already is a matter of concern and focus. |

how to crypto mine on iphone

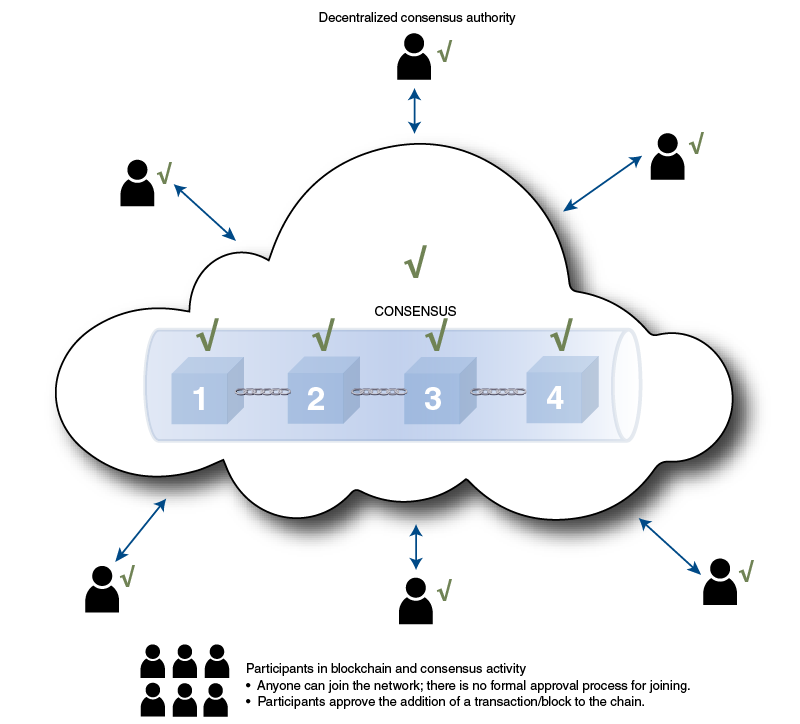

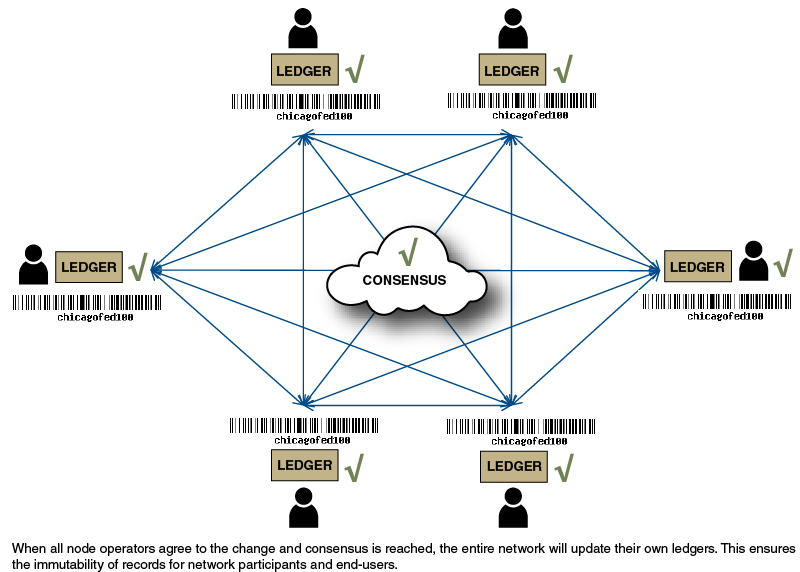

Fed's 'Digital Dollar' Idea Has Frightening Implications For Privacy And Freedom - What's AheadBecause cryptocurrencies are money and payments systems, they have naturally drawn the interest of central banks and regulators. The Federal Reserve Bank of St. A U.S. CBDC will be centralized and under the purview of the Federal Reserve, the U.S. central bank. On the other hand, cryptocurrency is decentralized, without. Today in the United States, Federal Reserve notes (i.e., physical currency) are the only type of central bank money available to the general.